Samsung’s Smartphone Sales Slow Down

Samsung’s Smartphone Sales Slow Down in India Despite Strong Profits

Samsung’s Smartphone Sales Slow Down in India. Samsung might be celebrating record profits globally, but things are looking a bit different in India. The South Korean tech giant’s smartphone sales have slowed down in one of its biggest markets, giving rivals like Vivo and Apple a chance to grab the spotlight.

Samsung Slips to Second Place in India’s Smartphone Market

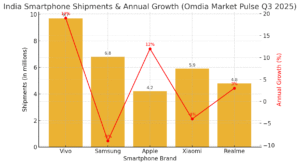

According to Omdia’s latest Q3 2025 report, Samsung shipped 6.8 million smartphones in India — a 9% decline compared to the same period last year when shipments hit 7.5 million. That drop also brought its market share down from 16% to 14%, marking a noticeable slowdown in momentum.

While Samsung still ranks second overall, its position is under pressure. Vivo has now taken the top spot with a 20% market share, shipping around 9.7 million smartphones — nearly 19% growth from last year. That’s a strong sign that Chinese brands continue to dominate the Indian market, offering high specs at competitive prices.

Entry-Level Phones Drag Samsung Down

Industry experts say the slowdown isn’t about the Galaxy S series or foldables — those are performing fairly well. The issue lies in Samsung’s budget lineup. The company’s entry-level smartphones simply aren’t matching the value proposition of competitors like Vivo, Redmi, and Realme.

In a price-sensitive market like India, small differences in specs and price can make or break sales. Phones under ₹15,000 remain the highest-selling category, and that’s where Samsung’s lineup feels less compelling. I think Samsung needs to rethink its strategy here, maybe by offering better chipsets or more aggressive pricing in this range.

Premium Phones Still Performing Strong

Interestingly, Samsung’s mid-premium and flagship models are still doing well. The Snapdragon variant of the Galaxy S24 and the newly launched Galaxy S25 FE have contributed to stable growth in higher segments. These phones have helped Samsung retain its loyal fan base among users who prioritize reliability, display quality, and after-sales service over raw specs.

That said, Apple’s growing popularity in India adds another layer of competition. With local manufacturing and discounts on older iPhones, Apple is quickly becoming a preferred choice for premium buyers — an area Samsung once dominated comfortably.

What’s Next for Samsung in India?

Samsung clearly understands the importance of India to its global strategy, so it’s unlikely to stay quiet. The company may soon refresh its Galaxy M and F series to better appeal to the mass market. We can also expect deeper offline retail expansion, as Samsung still enjoys strong trust among Indian consumers.

If it manages to fix its budget lineup while maintaining flagship innovation, Samsung can bounce back quickly. But right now, Chinese brands are dictating the pace.

Final Thoughts

Samsung’s recent slowdown in India isn’t catastrophic, but it’s a wake-up call. As competition heats up, especially from Vivo and Apple, Samsung needs to strike the right balance between innovation and affordability. For a brand that’s been leading the Android world for years, a small course correction might be all it takes to reclaim the top spot.

FAQs

Q: Why are Samsung’s smartphone sales dropping in India?

Because its entry-level phones are struggling to compete with Chinese brands offering better specs and prices in the same segment.

Q: Which brand leads the Indian smartphone market now?

Vivo currently holds the top spot with a 20% market share, followed by Samsung in second place.

Q: Is Samsung still performing well globally?

Yes, Samsung recently reported its highest profit in three years, even though sales in India have dipped.

Q: Are Samsung’s premium phones still selling well?

Yes, models like the Galaxy S24, S25 FE, and foldable devices continue to perform strongly in India’s mid-premium and flagship segments.

Founder of Sias Trend, covers India’s fast-growing mobile and automobile industries. With hands-on experience in digital ventures and tech trends, he shares insights on smartphones, electric vehicles, and the innovations driving India’s future in mobility and connectivity.